News

January 14th, 2013 by admin

Chemical producers abandoned the U.S. in droves. Cheap natural gas is luring them back.

- By Kevin Bullis on January 9, 2013

People predicting a manufacturing renaissance in the United States usually imagine whirring robots or advanced factories turning out wind turbines and solar panels. The real American edge might be in something entirely more mundane: cheap starting materials for plastic bottles and plastic bags.

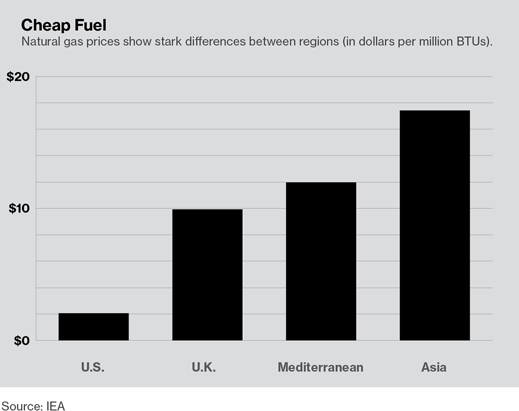

The plummeting price of natural gas, which can be used to make a vast number of products, including tires, carpet, antifreeze, lubricants, cloth, and many types of plastic, is luring key industries to the United States. Just five years ago, natural gas prices were so high that some chemicals manufacturers were shutting down operations here. Now the ability to access natural gas trapped in shale rock formations, using technologies such as hydraulic fracturing and horizontal drilling, has led to a surge in natural gas supplies that have lowered American gas prices to a fraction of prices in other countries (see “King Natural Gas”).

Over the last 18 months, low U.S. gas prices have prompted plans for the construction of new chemical plants for the production of ethylene, ammonia for fertilizer, and diesel fuels. Dow Chemical, for example, plans to spend $4 billion to expand its U.S. chemicals production, including a new plant, due to open in 2017, in Freeport, Texas. The plant will make ethylene from the ethane found in many sources of natural gas. (The last such plant to be built in the U.S. was completed in 2001).

The impact of the resurgence is being felt most strongly in the $148 billion market for ethylene, the world’s most high-volume chemical, and the foundation for many other industries. It’s used to make bottles, toys, clothes, windows, pipes, carpet, tires, and many other products. Since ethylene is expensive to transport over long distances, a new ethylene plant is typically integrated with a facility to convert it into polyethylene for plastic bags or ethylene glycol for antifreeze.

In the U.S., it currently costs $300 to make a ton of ethylene, down steeply from $1,000 a few years ago. According to an analysis by PricewaterhouseCoopers, it currently costs $1,717 to make it in Asia, where plants depend on high-priced oil instead of natural gas, and $455 per ton to make ethylene in Saudi Arabia, using a combination of ethane and butane. (Ethylene plants are also being built in Qatar, which, like the U.S., has very cheap natural gas.)

Over the last two years, manufacturers have announced plans to add 10 million metric tons of ethylene capacity in the United States by 2019. Those plans represent a 10 percent increase in global ethylene production and also account for close to half the industry’s planned expansions in all countries.

The impact of cheap natural gas on manufacturing could extend beyond the production of various chemicals. Using natural gas as an energy source, rather than a chemical feedstock, could significantly lower costs for manufacturers who use a lot of energy, such as steel makers. (The steel industry is booming already for another natural gas-related reason—it’s supplying gas producers with pipes.) What’s more, cheap natural gas is prompting a shift away from petroleum based-fuels for trucking. Some companies are switching to trucks that burn natural gas directly. Eventually, even diesel trucks could be using fuel made from natural gas. The South African company Sasol plans to build a huge $14 billion plant in Louisiana partly to convert natural gas to diesel, potentially lowering fuel costs for conventional vehicles as well.

Overall, cheaper chemicals, cheaper steel, and cheaper transportation could make the U.S. a far more attractive place for a wide range of industries.

Michael Levi, a senior fellow at the Council on Foreign Relations, says energy doesn’t exceed 5 percent of costs in most industries—not enough to make gas prices decisive for most companies choosing where to build manufacturing plants. Where cheap energy could matter most, he says, is giving existing U.S. factories a new reason not to close or move offshore. “Cheap natural gas might do more to keep existing manufacturing plants open than it will to get people to build new ones,” says Levi.

Just how long U.S. natural gas will stay relatively cheap is not clear. For capital investments to pay off, say analysts, oil prices need to stay high, and gas prices low, for years to come. That means chemical makers could still shift their plans. For instance, Sasol will reassess the economics of its planned plant for converting natural gas into diesel in 2014 before it breaks ground.