GPS readings in cities and indoors can be terrible. One startup has found a novel solution.

A new antenna design being tested by the U.S. Air Force could make GPS significantly more reliable and able to function in dense urban areas where GPS accuracy is weak. It might even allow the technology to work indoors in some cases.

Good GPS readings are hard to get in cities because of the multipath phenomenon: signals from positioning satellites bounce off buildings and other structures. That confuses GPS receivers, which calculate their location by knowing exactly how long it took for signals to arrive from satellites overhead.

A signal that has bounced takes longer to arrive than it would if it had traveled directly, muddying a receiver’s math and sending location readings off by tens or hundreds of meters. Smartphones and in-car GPS units often have to work out their true location by analyzing maps and by getting a series of readings over time.

Live: Our annual conference on emerging technologies is happening now.Watch EmTech

The Air Force Institute of Technology is now trying to tackle that problem with an antenna able to recognize and ignore multipath GPS signals. The project builds on a design invented by Locata, a company based in Canberra, Australia. The institute is testing the company’s soccer-ball-sized proof-of-concept prototype, and plans to adapt it into versions that could conform with the frame of a Humvee or aircraft, or be built into helmets.

As the U.S. military tries to automate aircraft and other vehicles, it must rely on GPS to know where they are. Nunzio Gambale, cofounder and CEO of Locata, says that what the Air Force develops stands a good chance of trickling down to civilians, since most GPS technology in smartphones and navigational aids originated with the military.

“The requirements of the military are now converging with the requirements of Apple and Google,” he says. “Everyone wants to use these location tracking-devices indoors and in urban areas where people say GPS will never work.”

Locata’s antenna has many different elements that can be activated individually. In the current prototype there are 80 such elements positioned around a sphere. Switching on each element individually for about one millisecond makes it possible for a receiver to sense not only the strength but also the direction of incoming signals, by comparing what is detected by the elements on different parts of the antenna.

That makes it possible to ignore GPS signals that have bounced in favor of pure ones coming directly from a satellite. “It’s like the blinders coming off,” says Gambale. He believes that in some circumstances the new antenna design could even allow GPS readings indoors, where multipath effects are extremely strong and the signals from positioning satellites are extremely weak.

Constructing antennas from multiple elements isn’t a new idea. But such designs traditionally had each element controlled by its own radio, causing different elements to interact with one another in ways that required complex additional processing to clean up. In Locata’s design, all elements connect to a single radio. The sequence of signals it produces from different antenna elements can be processed relatively easily.

Todd Humphreys, a professor at the University of Texas geopositioning lab, says that Locata’s design shows promise because it can be so much cheaper than previous attempts to address the multipath problem. However, he cautions that this approach to antenna design requires a large receiver, so for now it will be practical only in military applications.

Locata is leaving it up to the Air Force to work out how practical the 3-D antenna can be. Gambale says his company is instead focused on using the technology to improve a competing technology to GPS: a system of ground-based location beacons that allows location readings to within centimeters (see “Ultra-Fine Location Fixes”). Last year the U.S. Air Force commissioned a Locata system for the White Sands Missile Range in New Mexico. Locata is also working to sell systems to companies that operate mines and warehouses.

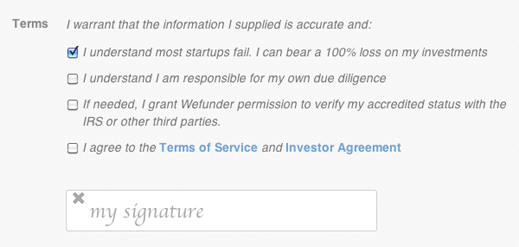

Due diligence: A sign-up screen at crowd investing site Wefunder cautions users that putting money behind startups is risky.

Due diligence: A sign-up screen at crowd investing site Wefunder cautions users that putting money behind startups is risky.